Zhixian Xu Unveils Aurava, a Digital Sanctuary for Collective Grief”

May 5, 2025

How Divya Kodi is Shaping the Future of Data and Cybersecurity

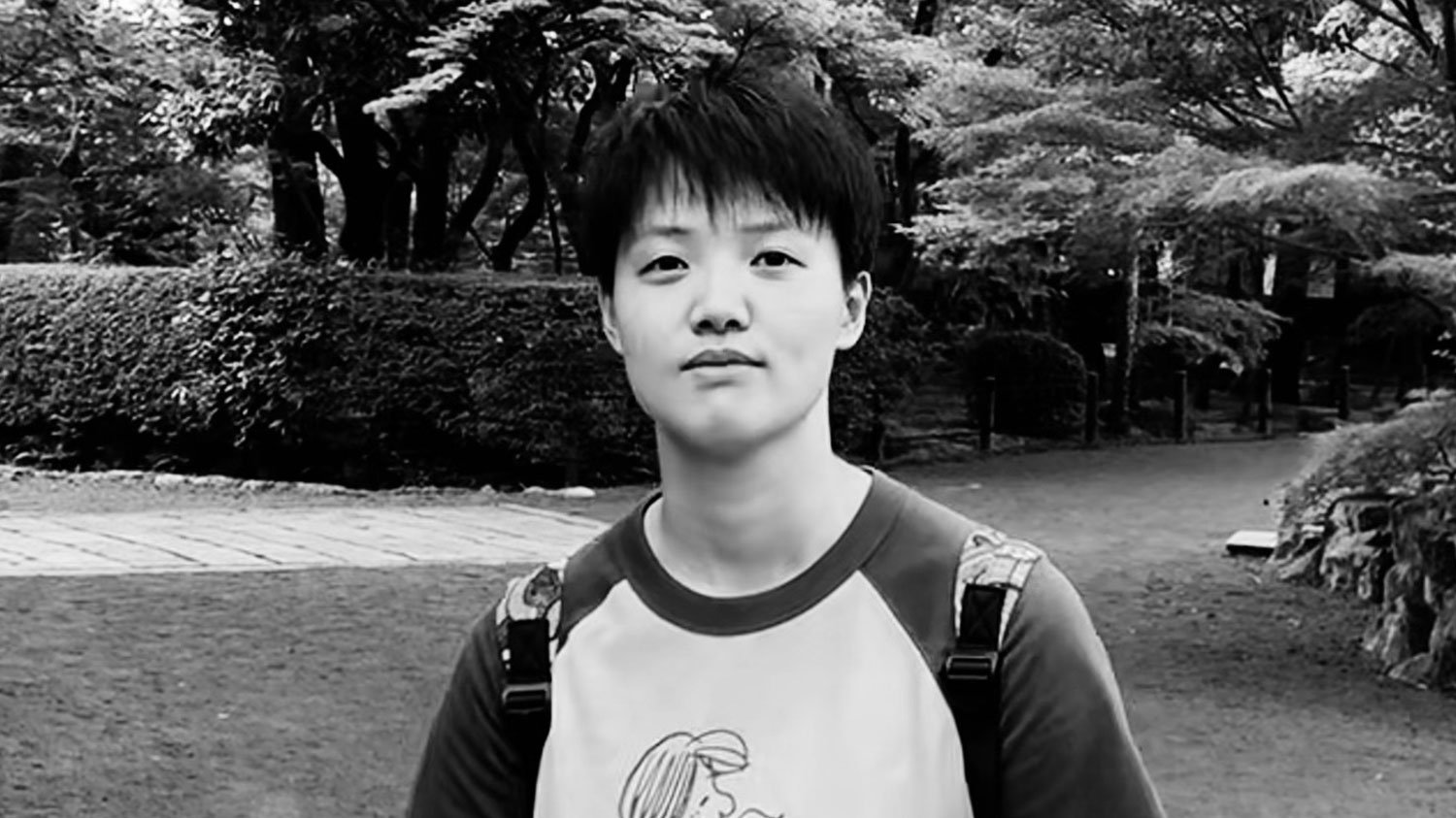

May 5, 2025Rohit Nimmala

Rohit Nimmala is a Senior Data Engineer specializing in financial risk analytics, where he leads initiatives that turn complex financial data into actionable insights for risk mitigation. With a background in computer science and a Master’s from the University of Cincinnati, he blends technical depth with business awareness to design predictive models that drive smarter decision-making in the banking sector.

I'm Rohit Nimmala, a Senior Data Engineer specializing in financial risk analytics. My work focuses on developing innovative data solutions that help financial institutions better understand, predict, and mitigate various forms of risk. I currently work in the banking sector, where I lead projects that transform complex data into actionable insights for risk management.

My background combines computer science and information technology, with a Master's from the University of Cincinnati and extensive experience across several leading organizations in the financial technology space.

When I first received the notification about winning gold in the Noble Business Awards, I was genuinely surprised and humbled. This recognition validates years of dedicated work in an often behind-the-scenes field of data engineering. Professionally, it acknowledges the importance of innovation in financial risk analytics, which is increasingly critical in today's volatile economic climate.

Personally, it's deeply gratifying to see my research and technical approaches recognized on an international platform. It reinforces my belief that focusing on the intersection of climate risk and financial stability is not just important work, but work that the industry values.

My inspiration came from wanting to showcase how data engineering can directly impact financial resilience, particularly through climate risk analytics. I believe my entry stood out because it demonstrated practical applications of cutting-edge techniques rather than just theoretical frameworks. The work combined real-time data processing systems with machine learning models that help financial institutions quantify and manage emerging risks.

What made me confident was the measurable impact of these solutions—improved forecasting accuracy, reduced processing time, and enhanced decision-making capabilities. I think the judges appreciated seeing innovation that bridges technical sophistication with practical business outcomes.

A defining turning point came during my transition from traditional data engineering to specialized financial risk analytics. I was working on a project analyzing loan portfolio data when I recognized a significant gap between available data and the insights needed for effective risk management. This realization led me to develop a novel approach combining multiple data sources with advanced predictive modeling.

The success of that initiative opened doors to more complex challenges and higher-impact projects. It taught me that technical expertise alone isn't enough—understanding the business context and having the courage to propose unconventional solutions is what truly drives innovation. That mindset has guided my work ever since and directly contributed to the achievements recognized by this award.

One of the most significant challenges was working with legacy systems that weren't designed for the scale and complexity of modern risk analytics. These systems often contained critical data but weren't easily integrated with newer platforms. My approach was to develop middleware solutions that could extract, transform, and harmonize data across disparate systems without disrupting ongoing operations.

Another obstacle was balancing computational efficiency with model accuracy, especially when processing real-time data streams for risk forecasting. We overcame this through careful architecture design and by implementing progressive loading techniques that prioritized critical risk indicators.

Perhaps the most persistent challenge has been communicating technical concepts to non-technical stakeholders. I've learned to translate complex data engineering concepts into business value propositions, which has been essential for gaining support for innovative approaches. Success in this field requires not just solving technical problems but also building consensus around new methodologies.

I see this award as an opportunity to advocate for greater investment in forward-looking risk analytics across the financial sector. I plan to leverage this recognition to foster more cross-disciplinary collaboration, particularly between data engineers, climate scientists, and financial risk managers.

I'm also developing educational content based on my research papers to help bridge the knowledge gap for professionals wanting to enter this specialized field. There's a significant talent shortage in financial risk analytics, and I believe sharing expertise is essential for industry advancement.

Additionally, I'm exploring opportunities to contribute to open-source projects that democratize access to risk modeling tools, allowing smaller institutions to benefit from sophisticated analytics that have traditionally been available only to large enterprises. At its core, my goal is to transform this individual recognition into broader positive impact throughout the industry.

The greatest benefit of participating in competitions like the Noble Business Awards is the structured opportunity to step back and critically evaluate your own work from different perspectives. The submission process forces you to articulate not just what you've accomplished, but why it matters and how it advances the field. This reflection often reveals insights about your own work that might otherwise remain unrecognized.

Another valuable aspect is the exposure to other innovative approaches across the industry. Even though I work in a specialized field, seeing how professionals in adjacent areas tackle complex problems has inspired new thinking in my own work.

Finally, the validation from independent experts provides credibility that helps advance new methodologies. In data engineering and risk analytics, where new approaches often face institutional resistance, external recognition can significantly accelerate adoption of innovative techniques.

This achievement wouldn't have been possible without the collaborative efforts of several key individuals. I'm particularly grateful to my technical team who helped implement and refine the data processing architecture that underpins our risk analytics platform. Their willingness to experiment with new approaches and attention to detail during implementation was invaluable.

I'd also like to acknowledge the risk management professionals who provided domain expertise and helped translate technical capabilities into practical risk frameworks. Their insights ensured our solutions addressed real business needs rather than just technical possibilities.

And finally, I'm indebted to mentors who have guided my professional development over the years. Their encouragement to publish research papers and participate in the broader data science community laid the foundation for the body of work recognized by this award. Success in innovative fields is always a collective achievement, even when individual recognition is given.

I see several transformative trends reshaping financial risk analytics.

First, climate risk is rapidly evolving from a peripheral concern to a central component of financial stability analysis. The integration of climate data with traditional financial models is creating entirely new methodological challenges and opportunities.

Second, regulatory frameworks around the world are increasingly demanding more sophisticated, transparent, and forward-looking risk assessments. This is driving demand for explainable AI and robust scenario analysis capabilities.

Third, the democratization of advanced analytics through cloud services and open-source tools is allowing smaller institutions to implement sophisticated risk management approaches previously available only to industry giants.

To adapt to these changes, I'm focusing on developing modular, scalable architectures that can accommodate rapidly evolving data sources and regulatory requirements. I'm also investing significant time in exploring quantum computing applications for risk simulation, as this technology may fundamentally change computational approaches to complex risk scenarios within the next decade.

I would advise my younger self to balance technical depth with business acumen earlier in my career. While technical skills are fundamental, understanding the business context—how financial institutions operate, how risk impacts decision-making, and how technology creates value—accelerates your impact dramatically.

For someone starting out, I'd emphasize the importance of finding intersections between emerging technologies and persistent industry challenges. The most valuable innovations often come from applying new tools to longstanding problems rather than creating solutions in search of problems.

I'd also stress the value of communication skills. In specialized technical fields, your ability to articulate complex concepts to diverse audiences—from technical teams to executive leadership—can be as important as your technical expertise. Invest time in developing clear, compelling ways to explain your work.

Finally, I'd encourage cultivating a global perspective. Financial markets and their associated risks are increasingly interconnected across borders. Understanding different regulatory approaches, market structures, and cultural contexts provides invaluable insight when designing robust analytical frameworks.

For those considering entering competitions like the Noble Business Awards, I recommend focusing on three key elements in your submission.

First, clearly articulate the problem you're solving and why it matters. Judges are looking for innovations that address meaningful challenges, not technical sophistication for its own sake.

Second, provide concrete evidence of impact. Quantitative measures of improvement—whether in efficiency, accuracy, cost reduction, or other metrics—strengthen your submission significantly. Theoretical benefits are interesting, but demonstrated results are compelling.

Third, tell a coherent story that connects your innovation to broader industry trends or challenges. Contextualizing your work helps judges understand not just what you've done, but its significance within your field.

From a practical standpoint, start the submission process early to give yourself time for refinement. Have colleagues from different backgrounds review your materials to ensure they're clear to diverse audiences. And don't underestimate the importance of presentation—clear organization, professional documentation, and attention to submission guidelines all contribute to how your work is perceived.

I think if there’s one thing I’ve learned on this journey, it’s that transformation doesn’t always begin with technology—it begins with mindset. Whether you're a startup founder, a tech lead, or part of a large enterprise team, the willingness to challenge the status quo and imagine better ways of working is where real innovation starts.

We’re living in a time where AI and automation are evolving fast, and it’s easy to feel overwhelmed by all the change. But the truth is, this is also a time of incredible opportunity—to simplify complexity, improve lives, and build systems that are not only smarter, but also more human-centered.

To the business community: keep building, keep questioning, and keep sharing your wins and lessons. Awards like this remind us that the work we do behind the scenes matters—and when we lift each other up, we all go further.

Winning Entry

Rohit Nimmala | Noble Business Awards

As a senior data engineer at Bank of America, I operate within a dynamic, high-stakes environment focused on leveraging advanced data engineering and... (read more here)

Rohit Nimmala

Rohit Nimmala is a Senior Data Engineer specializing in financial risk analytics, where he leads initiatives that turn complex financial data into actionable insights for risk mitigation. With a background in computer science and a Master’s from the University of Cincinnati, he blends technical depth with business awareness to design predictive models that drive smarter decision-making in the banking sector.

Read more insights on the interview titled - Tech That Delivers: Inside Ramesh Pingili’s Automation Frameworks here.